How to Calculate Overtime in Malaysia

In this article we will study the laws governing the hours of work and overtime work for employees under Malaysias labour laws. But overtime can be a very confusing matter.

Your Step By Step Correct Guide To Calculating Overtime Pay

In this article we will go through all the different Malaysia leave types and overtime rates covered under the Employment Read more.

. And overtime pay of RM 36611 based on 131 salaries. The legal minimum notice period. Checking the notice period.

It is a simple and easy payroll software system by allowing your company employee SOCSO calculation Malaysia can be done easily and efficiency. Gain visibility into actual costs vs. Provides details on values used to calculate EPF SOCSO EIS and PCB.

1778 X 05 889. IFLEXiHRMS Payroll System free up your time from tedious and complex payroll calculations preparation. This can be used to verify or modify these calculations as needed.

To find the employees overtime rate multiply their week 4 hourly rate of 1778 by 05 or divide by two. There are two ways to calculate PCB - the computerised method and the non-computerised calculation. Ensure you request for assistant if you cant find the section.

Liza on Employees earning up to RM4000month will be entitled to overtime. Pending payroll transactions Enter overtime claims allowances bonus leaves tax benefits and other deductions in advance and incorporate it later on into the final payroll for that. Since 2020 the default.

One day this employee works overtime for a total of 2 hours. If you want to find out more about the different types of leave entitlements in Malaysia click here or you can find out about overtime pay rates hereAnd of course for all things HR head over to the altHR resources page. After filling out the order form you fill in the sign up details.

Submit regulatory forms in seconds have EPF and SOCSO automatically calculated for you and generate bank files to pay all your employees at one go. In the event you are looking for ERP system with an affordable HR Payroll read this HR Payroll for Malaysia. Overtime on Public Holidays.

The calculation of overtime in Malaysia is rather simple than the working and non-working days. In addition to the PH pay employees get OT of 2 times the ORP for one day. Must-know Malaysia Leave Types and Overtime Pay Rates is an article written by Nan An and further updated by Hern Yee from Talenox.

With scheduling attendance and leave management features it can help automate complex tasks and allow you to spend less on labour saving up to 33 percent in unplanned overtime ³. Malaysia passes Anti-Sexual Harassment Bill with very minor amendments despite widespread criticism. Users can further customise the computation for allowance overtime and shift calculation with a built-in formula builder.

In Malaysia overtime is still popular among companies especially in the FB sector. The Malaysian GDP grew at an average of 65 per annum for almost 50 years complemented by its amazing geographic location and multilingual mix of Malay Indian and Chinese populace. Overtime entitlements under the Employment Act in Malaysia.

Send copies of the form to the IRS and the independent contractor by January 31 of the following tax year. Now multiply the employees overtime pay by how much overtime they worked 5 hours. JustLogin is fully integrated so no pay leave and overtime hours are factored into pay calculations.

Calculate the total compensation paid. Any hours exceeding normal working hours is paid at. If an employee is off work during their notice period the amount theyre paid will depend on the type of notice they have.

Note the amount of taxes withheld if backup withholding applied. Leave loading is generally paid at a rate of 175 of an an employees regular pay but can vary. Then calculate the overtime pay rate by multiplying the hourly rate by 15 and then multiply that figure with the number of.

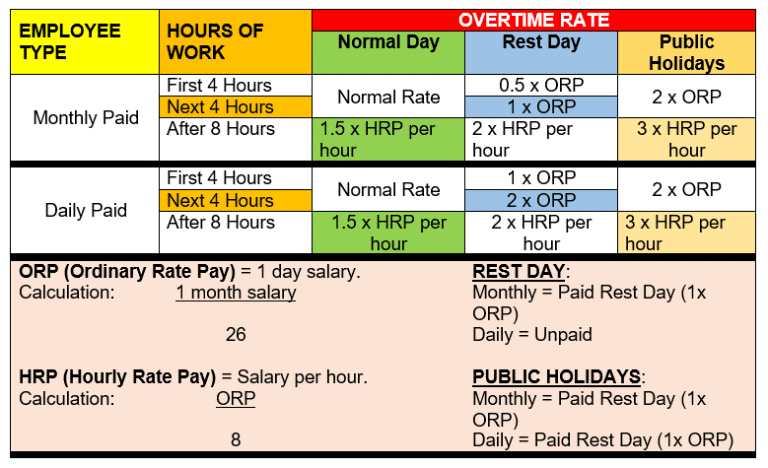

How to calculate Ordinary Rate of Pay and Hourly Rate of Pay. If you are interested to know the calculation of the EPF contribution formula you have came to the right place. Process Overtime Days or Overtime Hours.

An employee works normal working hours of 8 hours a day earning RM50 on a daily basis. 11 minutes Editors note. Anyone legally classed as an employee must be paid as normal for any time they work during their notice period.

Its important to check the employment contract to confirm if the employee has either. More than 25 Malaysia banks including Maybank Hong Leong Bank Cimb bank public bank can be used to perform bank giro on SQL Payroll Malaysia software. A Brief Guide to the Different IR56 Forms in Hong Kong.

Transfer payroll entries into your accounting software in just a click of a button. 889 X 5 4445. If the employees salary does not exceed RM2000 a month or falls within the First Schedule of.

No Time limit on software and is free to be used as long as needed. RHB said the companys move to call off plans to list its Malaysia NFO operation in Singapore may have been a blessing in disguise as the proposal would eventually have diluted BSTs interest in the latter to 287 from 100 which would then subject BST to a holding company discount due to loss of a directly-owned business. Divide the employees daily salary by the number of normal working hours per day.

Crystal on Employment Act to apply to all employees from 1 September 2022 some sections subject to increased salary threshold of RM4000month. Benefits of paying independent contractors through a payroll system. An early career Software Engineer with 1-4.

There are only two conditions to cater to. Scheduled earned hours overtime and other real-time reporting that can help you and your managers stay on budget. Calculate the 20-year net ROI for US-based colleges.

At the end of the day keeping track of your leave entitlements and understanding your rights and legal obligations is crucial. Calculation of overtime on Public holiday PH which is recognised by employer. Having different types of payment modes for your employees is not a problem as it can calculate hourly daily and monthly salaries.

RM50 8 hours RM625. This best payroll software in Malaysia can handle multiple company transactions at a time. When an employee takes leave leave loading is automatically added to their pay and is in addition to their base rate of pay.

Calculation details can be exported to Excel for further calculations and reports. You must calculate the employees overtime pay for the week they worked 45 hours. If the overtime on a public holiday did not exceed normal working hours the rate is 2 times of employees daily rate.

When you are done the system will automatically calculate for you the amount you are expected to pay for your order depending on the details you give such as subject area number of pages urgency and academic level. Heres the computerised method to calculate PCB. To calculate in Excel how many hours someone has worked you can often subtract the start time from the end time to get the difference.

Standard Employer EPF Rate is 13 if the Salary is less than RM5000 while 12 if the Salary is more than RM5000. But if the work shift spans noon or midnight simple. An entry-level Chief Executive Officer CEO with less than 1 year experience can expect to earn an average total compensation includes tips bonus and overtime pay of RM 200000 based on 5.

Written by Nicholas Updated over a week ago For employees paid on a monthly basis overtime entitlements under the Employment Act are as follows.

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Comments

Post a Comment